operating cash flow ratio importance

It reflects the amount of cash that a business produces solely from its core business operations. Operating cash flow is particularly important for investors who often look at both OCF and net income when deciding to invest or not.

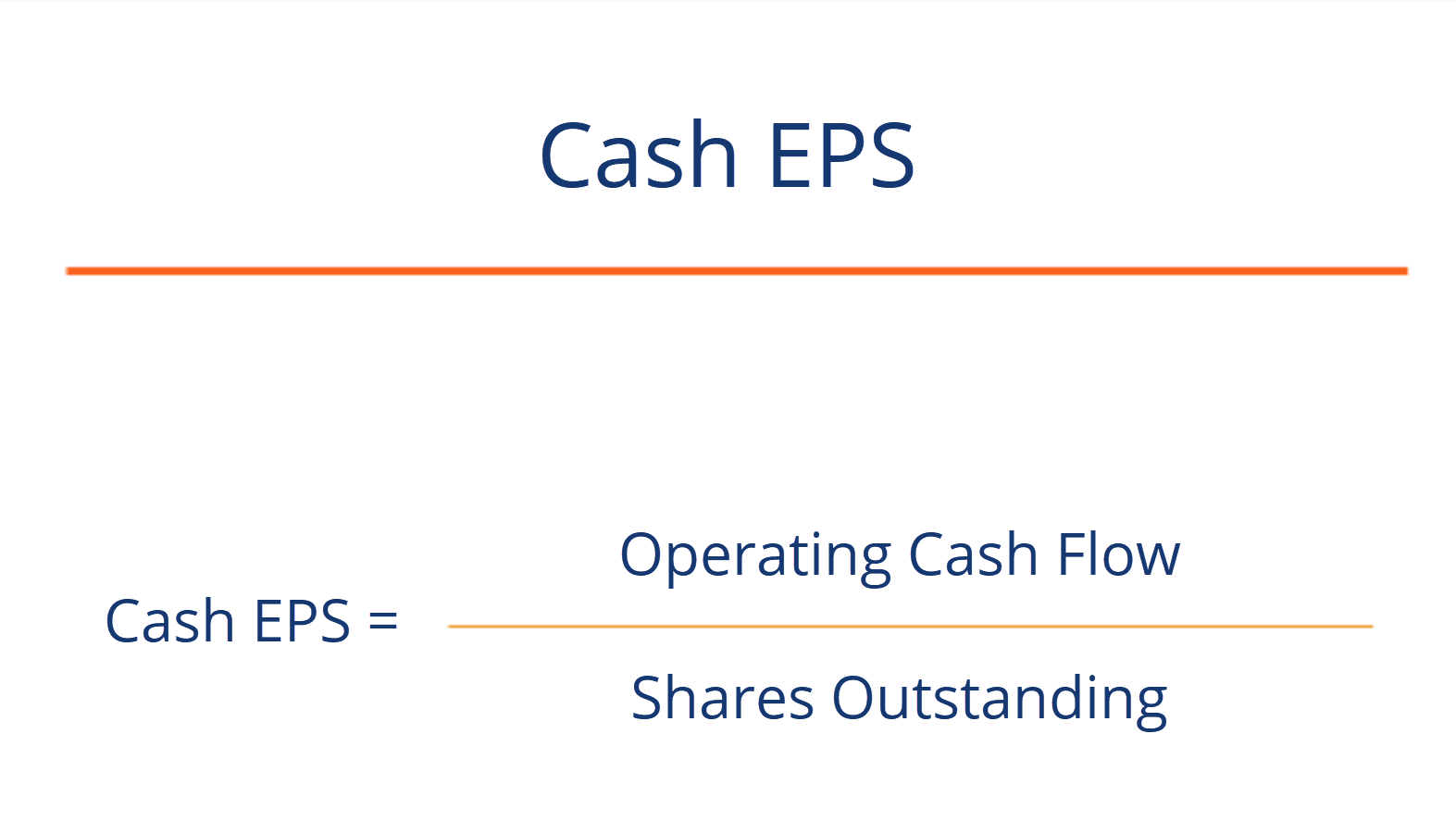

Cash Eps Operating Cash Flow Divided By Shares Outstanding

Thus investors and analysts typically prefer higher operating cash flow ratios.

. Operating Cashflow Ratio is a liquidity KPI ratio that measures a companys ability to pay for short-term liabilities with cash generated from its core operations. Operating cash flow ratio CFO Current liabilities. Operating cash flow ratio determines the number of times the current liabilities can be paid off out of net operating cash flow.

Over time a businesss cash flow ratio amount should increase as it demonstrates financial growth. They are an essential element of any analysis that seeks to understand the liquidity of a business. Free cash-flow operating cash flow is a significant ratio for users interested in understanding cash that may be available for additional activities.

Therefore cash is just as important as sales and profits. It should be considered together with other liquidity ratios such as current ratio. The operating cash flow ratio is a measure of how readily current liabilities are covered by the cash flows generated from a companys operations.

While net income shows if the company is keeping its head above water for now its operating cash flow shows if its actually making moneyand few investors want to put their money down on a business that doesnt generate. Cash flow from operations Long Term Debt Fixed Assets Purchased Dividends Paid. The figure for operating cash flows can be.

Operating cash flow Sales Ratio Operating Cash Flows Sales Revenue x 100. Operating cash flow is a measure that is used to gauge how much money is flowing into and out of a particular company. Operating Cash Flow 55000.

Operating cash flow is the first section depicted on a cash flow statement. A higher level of cash flow indicates a better ability to withstand declines in operating performance as well. Operating Cash Flow Net Income - Changes in Assets and Liabilities Non-Cash Expenses 100000 50000 20000 25000 10000.

The number is different from net income although it is very similar. This is because it shows a better ability to cover current liabilities using the money generated in the same period. LENDERS RATING AGENCIES AND WALL STREET analysts have long used cash flow ratios to evaluate risk but auditors have been slow to use them.

Operating cash flow ratio is an important measure of a companys liquidity ie. The operating cash flow refers to the cash that a company generates through its core operating activities. If a company has a positive operating cash flow this means that it is bringing in more money than it is sending out.

If it is higher the company generates more cash than it needs to pay off current liabilities. Cash Flow Coverage Ratio The cash flow coverage ratio is a good general evaluation metric but it can also be particularly important for businesses such as hospitals and medical practices. Long Term Debt refers to debt repayment on long term debt ie.

Calculation formula The formula for this ratio is simple. This may signal a need for more capital. Cash flow ratios compare cash flows to other elements of an entitys financial statements.

Most credit analysts and many investment analysts consider free cash flow the most important factor to consider when making recommendations. When evaluating this measure the higher resulting ratio is better. This ratio indicates the ability of a company to translate its sales into cash.

This ratio calculates how much cash a business makes as a result of sales. Operating Cashflow Ratio Operating cash flow Current liabilities. Operating cash flow ratio is an important measure of a companys liquidity ie.

This ratio can be calculated from the following formula. CFO Ratio 066. The operating cash flow ratio is a measure of a companys liquidity.

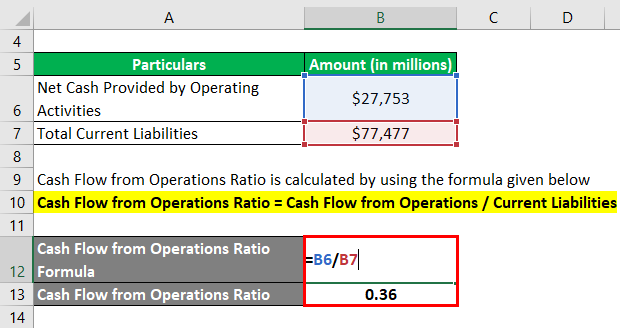

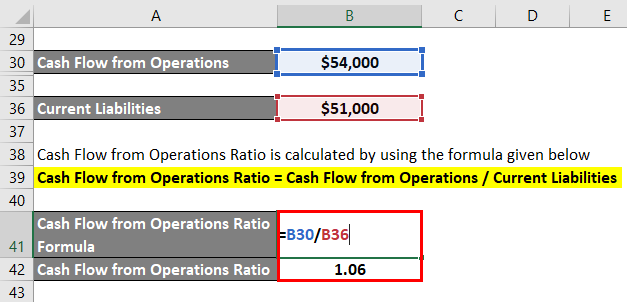

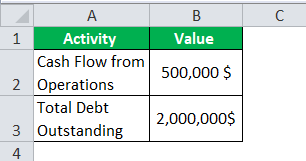

Operating cash flow OCF is one of the most important numbers in a companys accounts. Cash Flow from Operations Ratio Cash Flow from Operations Current Liabilities. The Operating Cash to Debt Ratio measures the percentage of a companys total debt that is covered by its operating cash flow for a given accounting period.

A higher level of cash flow indicates a better ability to withstand declines in operating performance as well as a better ability to pay dividends to investors. Operating cash flow ratio. If it has a negative operating cash flow it means that the.

This usually represents the biggest stream of cash that a company generates. In the case of a small business cash is very important for survival. Debt Service PI 200M Margin 150M DCR 175X Note.

Operating cash flow is intensely scrutinized. CASH FLOW RATIOS ARE MORE RELIABLE indicators of liquidity than balance sheet or income statement ratios such as the quick ratio or the current ratio. Cash flow ratios are sometimes reserved for advanced financial analysis.

A preferred operating cash flow number is greater than one because it means a business is doing well and the company is enough money to operate. It would serve a business owner or manager well to calculate the cash flow ratios in order to have an accurate picture of the actual cash position and viability of the business. Cash Flow Adequacy Ratio Operating cash flows ie.

Operating cash flow is an important benchmark to determine the financial success of a companys core business activities. This ratio is an important liquidity ratio and is computed using the following formula. Operating cash flow ratio analysis is an effective way to measure how well a company can pay off its current liabilities using the cash flow generated from ongoing business activities.

This ratio can help gauge a companys liquidity. The ideal ratio is close to one. If the operating cash flow coverage ratio is greater than one as in the example above the company will have generated enough cash to pay off all their current liabilities for the year.

A higher ratio is more desirable. Had a cash flow ratio of 066 which indicates that it can cover up to 66 of the current liabilities with its cash flow from operating activities. Paying down of debt.

CFO Ratio 77434 Mn 116866 Mn. A higher ratio is better. If the operating cash flow is less than 1 the company has generated less cash in the period than it needs to pay off its short-term liabilities.

So we can see that Radha succeeded in generating 55000 of cash flows from her operations. Its ability to pay off short-term financial obligations. It is important to understand cash flow from operations also called operating cash flow the numerator of the operating cash flow ratio.

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Cash Flow Per Share Formula Example How To Calculate

Price To Cash Flow Formula Example Calculate P Cf Ratio

Free Cash Flow Formula Calculator Excel Template

Cash Flow From Operations Ratio Top 3 Examples Of Cfo Ratio

Cash Flow To Debt Ratio Meaning Importance Calculation

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow From Operations Ratio Formula Examples

Operating Cash Flow Ratio Definition Formula Example

Operating Cash To Debt Ratio Definition And Example Corporate Finance Institute

Operating Cash Flow Formula Examples With Excel Template Calculator

Price To Cash Flow Formula Example Calculate P Cf Ratio

Cash Flow From Operations Ratio Formula Examples

Fcf Formula Formula For Free Cash Flow Examples And Guide

Operating Cash Flow Ratio Definition And Meaning Capital Com

Cash Flow To Debt Ratio How To Assess Debt Coverage Ability

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)